In the February issue of Chauffeur Driven, we viewed five pending legislative changes in 2024. As the year has progressed, some of this legislation has been finalized, while other regulations are still in development or review. With a busy HR compliance landscape, it’s worth pausing for a midyear review and update! Let’s take a closer look.

1. (Status: Vacated) National Labor Relations Board (NLRB) Joint Employer Standard c The NLRB’s new Joint Employer rule was set to take effect in February, then stayed until March 11, 2024, and has since been vacated by a US District Court in Texas. The new rule would have adjusted the definition of a “joint employer” for the purposes of claims related to worker rights guaranteed in the National Labor Relations Act. Those rights include collective bargaining and other concerted efforts to improve working terms and conditions:

1. (Status: Vacated) National Labor Relations Board (NLRB) Joint Employer Standard c The NLRB’s new Joint Employer rule was set to take effect in February, then stayed until March 11, 2024, and has since been vacated by a US District Court in Texas. The new rule would have adjusted the definition of a “joint employer” for the purposes of claims related to worker rights guaranteed in the National Labor Relations Act. Those rights include collective bargaining and other concerted efforts to improve working terms and conditions:

❱ Wages and benefits ❱ Discipline

❱ Hours of work ❱ Supervision

❱ Hiring and firing ❱ Direction

With the new rule vacated, the previous 2020 rule stands—for now:

The 2020 rule determines a joint employer as a company that possesses and exercises substantial direct and immediate control over one or more essential terms and conditions of employment of another employer’s employees. The rule specifies the essential terms and conditions of employment as listed above.

We are likely to see more on this subject, according to this statement from the NLRB Chairman Lauren McFerran: “The District Court’s decision to vacate the Board’s rule is a disappointing setback but is not the last word on our efforts to return our joint-employer standard to the common law principles that have been endorsed by other courts. The Agency is reviewing the decision and actively considering next steps in this case.”

Find the complete language of the now-vacated new rule here: bit.ly/4b0AMdw.

Note that the NLRB Joint Employer Rule does not affect the Department of Labor’s definition of “joint employer” used in enforcement of the Fair Labor Standards Act (FLSA), which addresses items like minimum wage and overtime rules.

2. (Status: Finalized and In Effect) Equal Employment Opportunity Commission (EEOC) Enforcement Guidance on Harassment

After 25 years without a change, the EEOC has finalized their updated enforcement guidance regarding harassment. The EEOC guidance explains the legal standards for harassment and employer liability in harassment claims. In effect as of April 24, the new guidance supersedes previous long-standing documents.

The EEOC laid out its broad priorities for 2024-2028:

❱ Eliminating barriers in recruitment and hiring

❱ Protecting vulnerable workers and persons from underserved communities from employment discrimination

❱ Addressing selected emerging and developing issues

❱ Advancing equal pay for all workers

❱ Preserving access to the legal system

❱ Preventing and remedying systemic harassment

Workplace harassment is a complex issue, and the new guidance is nuanced. It is worth taking some time read the new language for yourself: https://bit.ly/3VJDugy.

3. (Status: Finalized and In Effect) Occupational Safety & Health Administration (OSHA) Representatives of Employers and Employees Regulation

The final rule took effect on May 31, and clarifies the “Worker Walkaround Representative Designation Process,” notably that a designated “walkaround” representative during an OSHA Inspection, may be either an employee or a third party (non-employee). The updated rule details the knowledge, skills, and experience required of a third-party representative, as well as the circumstances under which a third-party representative is “reasonably necessary” to the inspection. It is anticipated this will open the door for union representatives to be present under certain circumstances.

Details can be found here: https://bit.ly/45DzZNz.

4. (Status: Effective as of March 11, Active Legal Challenges) Department of Labor (DOL) Independent Contractor Classification Under the FLSA

This update did indeed take effect as of March 11, 2024, and is currently the standard. However, multiple active court cases are in play that could stay or even vacate the regulation. At the time of drafting this article, the new Independent Contractor rule remains in effect.

The DOL’s updated Independent Contractor standards are essentially a return to pre-2021 guidelines where six factors are weighed equally, rather than the first two being the primary determinants.

❱ The degree to which the employer controls how the work is done.

❱ The worker’s opportunity for profit or loss.

❱ The amount of skill and initiative required for the work.

❱ The degree of permanence of the working relationship.

❱ The worker’s investment in equipment or materials required for the task.

❱ The extent to which the service rendered is an integral part of the employer’s business

For the last few years, the Independent Contractor standard has been focused on the first two bullet points above, which has been fairly easy to prove. The updated standard brings all six factors back into equal play, meaning we can anticipate closer scrutiny on assignment of Independent Contractor status, with the intention of avoiding misclassifications. The new rule can be found here: https://bit.ly/3SwOM7P.

5. (Status: Due July 1, Pending Legal Challenges) DOL Minimum Salary Threshold for Overtime Exemptions

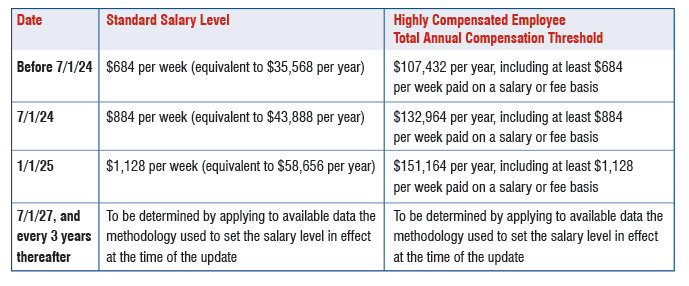

The DOL published its final rule, which would increase the minimum salary threshold for Exempt employees (specifically those exempt from overtime pay). This increase would begin with two steps, July 1, 2024; then January 1, 2025. As a reminder, in order to be exempt from overtime pay there are standards both for the employee’s role, and for their compensation level and type. The proposed updates would maintain the requirement for salary type pay and increase the minimum amount. The DOL published this chart to clarify the new rule:

Additionally, the new rules would incorporate automatic updates, with salary thresholds being reviewed and updated every three years. The goal overall is to provide protections for overtime pay to a greater part of the workforce, as to reflect current earnings data. Expect the final rule sooner than later.

Additionally, the new rules would incorporate automatic updates, with salary thresholds being reviewed and updated every three years. The goal overall is to provide protections for overtime pay to a greater part of the workforce, as to reflect current earnings data. Expect the final rule sooner than later.

Further information: https://bit.ly/3XFeqtJ.

As always, these updates are current as of the drafting of this article but reflect a fluid landscape in HR compliance. You don’t have to go it alone—partner with an HR expert or attorney to stay ahead of the game. [CD0624]

Amy Cooley is HR Leader for the LMC Groups. She can be reached at amy@lmcpeople.com.